Seamless Travel Payments: OCBC’s Digital App Empowers Customers with UnionPay QR Solution

OCBC Singapore introduces a seamless payment solution through its OCBC Digital app, allowing customers to make retail payments to UnionPay QR-enabled merchants across 47 markets. The initiative eliminates the need for separate payment apps and currency exchange, providing enhanced convenience for travelers. 3 August 2023 – OCBC Singapore customers are set to experience a new level of convenience while traveling, as the bank...

Qashier Unveils Revolutionary QashierX2 Smart POS Terminal to Empower SMEs

Qashier, the fintech startup, introduces the QashierX2 smart POS terminal, an innovative all-in-one solution empowering SMEs with seamless payment acceptance and streamlined operations, consolidating various digital payment options and essential business functionalities in a single device. 27 July 2023 – Singapore-based fintech startup, Qashier, has introduced its latest innovation, the QashierX2, an advanced smart point-of-sale...

Shopee Singapore Unveils Strategic Initiatives to Empower Retailers and Enhance Online Shopping Experience

Shopee Singapore introduces strategic initiatives to empower retailers, including next-day delivery for selected sellers, enhanced coins cashback programme, preferential shipping rates, and access to MariBank’s business banking suite. The platform also offers 30% vouchers during Shopee Live sessions to engage buyers in real-time and foster an interactive shopping experience. 25 July 2023 – Shopee Singapore, a leading...

Amazon Global Selling Launches Cross-Border Brand Launchpad to Empower Singapore MSMEs in E-commerce Expansion

Amazon Global Selling introduces the ‘Amazon Global Selling Singapore Cross-border Brand Launchpad’ program in collaboration with Enterprise Singapore and Singapore Business Federation, empowering over 100 local MSMEs to launch and scale their brands in the U.S. through tailored account management support. Additionally, a knowledge collaboration will provide essential cross-border e-commerce learning opportunities to at...

E-shopaholics: The Driving Force Behind Southeast Asia’s E-commerce Boom

E-shopaholics, constituting 15% of the Southeast Asian e-shopper population, are responsible for a significant 45% of all e-commerce purchases, according to a study conducted by Ninja Van Vietnam and Geopost. Expert online shoppers, they demonstrate an impressive proficiency in navigating the e-commerce ecosystem, making them a vital force in the region’s thriving digital retail industry. 22 July 2023 – A recent study...

Opn Launches Atome BNPL Service in Malaysia and Singapore, Empowering Flexible Payment Solutions for Consumers and Merchants

Opn Holdings’ Opn Payments platform launches Atome, a Buy Now Pay Later (BNPL) payment method, in Malaysia and Singapore, offering consumers the convenience of splitting payments into three installments over three months without extra fees. Merchants receive the full payment upfront, while the popularity of BNPL grows in the region due to higher purchasing power for consumers without credit cards. 20 July 2023 – Opn...

Singapore’s Digital Banks Advocate Deposit Cap Removal to Foster Growth and Competition

Singapore’s digital banks, backed by Grab Holdings and Sea Ltd., are pressing the Monetary Authority of Singapore to remove the deposit cap hindering their growth and lending abilities. With profitability targets to meet, these banks seek to scale and compete with traditional banks while assuring consumer protection and long-term viability. 14 July 2023 – Singapore’s digital banks, backed by industry giants Grab...

Standard Chartered Singapore and Atome Celebrate Successful Partnership with 100,000 Transactions and Expansion Plans

Standard Chartered Singapore and Atome, the buy now pay later platform, celebrate the achievement of 100,000 transactions under their Lender of Record partnership. The successful collaboration has demonstrated strong customer growth and will now expand to Malaysia after its successful rollout in Singapore and Indonesia. SINGAPORE, 6 July 2023 – Standard Chartered Singapore and Atome, the buy now pay later platform, are pleased...

Amazon Singapore and YouGov Survey Unveils Growing Emphasis on Product Quality and Authenticity in Online Shopping

Amazon Singapore and YouGov’s recent survey highlights the growing importance of product quality and authenticity for online shoppers, with consumers showing a willingness to pay higher prices for reliable products. The survey also emphasizes the shared responsibility of sellers, distributors, and e-commerce platforms in ensuring authenticity and building consumer trust. SINGAPORE, 4 July 2023 – In a recent collaboration...

VMware Partners with AMD, Samsung, and RISC-V Community to Simplify Confidential Computing Applications at Confidential Computing Summit 2023

VMware, in collaboration with AMD, Samsung, and the RISC-V Keystone community, is simplifying the development and operations of confidential computing applications through their joint efforts on the Certifier Framework for Confidential Computing project. This open-source initiative aims to standardize and streamline the adoption of confidential computing, enabling secure multi-cloud deployments and protecting sensitive data in...

Grab Holdings Implements Workforce Restructuring to Enhance Long-term Affordability

Grab Holdings, the leading ride-hailing and food delivery app in Southeast Asia, has announced a workforce reduction of 1,000 employees, approximately 11% of its workforce. CEO Anthony Tan emphasizes that this strategic restructuring is driven by the need to manage costs effectively and ensure long-term affordability, adapting to the evolving business landscape. SINGAPORE, 20 June 2023 – Grab Holdings, the leading ride-hailing...

Monetary Authority of Singapore Launches Global FinTech Hackcelerator Focused on Artificial Intelligence in Finance

The Monetary Authority of Singapore (MAS) has announced the launch of the 8th edition of the Global FinTech Hackcelerator, titled “Artificial Intelligence (AI) in Finance Global Challenge.” The competition aims to generate innovative and market-ready AI solutions that can transform the financial services industry. The event is conducted in partnership with AI Singapore (AISG) and powered by Oliver Wyman. Participants from...

Smiles Mobile Remittance Revolutionizes Bill Payment for Filipinos in Singapore

Digital Wallet Singapore Pte. Ltd. has announced that its mobile money transfer app, Smiles Mobile Remittance, now offers a Bills Payment feature for Filipinos living in Singapore. This feature allows users to conveniently pay bills in the Philippines using only their smartphone, saving time and money compared to visiting a physical payment location. Customers can pay off or contribute to government loans, insurances, electricity and...

MAS Launches Net Zero Action Plan

Deputy Prime Minister and Minister for Finance, Heng Swee Keat, and Deputy Chairman of the Monetary Authority of Singapore (MAS), Lawrence Wong, today announced the launch of MAS’ Finance for Net Zero (FiNZ) Action Plan. The plan expands on MAS’ Green Finance Action Plan launched in 2019 and sets out MAS’ strategies to mobilize financing for Asia’s net zero transition and decarbonization activities in Singapore...

UOB and Lazada Announce Regional Strategic Partnership to Enhance Payment and Financial Services

UOB and Lazada Group have entered a Memorandum of Understanding (MOU) to collaborate on retail products and banking solutions for their combined customer base across Singapore, Malaysia, Indonesia, Thailand, and Vietnam. This partnership will be Lazada’s first with a bank for various payments and financial services in Southeast Asia and UOB’s first regional collaboration with an e-commerce platform. The collaboration aims...

Volopay Secures In-Principle Approval for Major Payment Institution License from MAS

Volopay, a Singapore-based fintech start-up, has announced that it has received in-principle approval for a major payment institution licence from the Monetary Authority of Singapore (MAS). This licence means that Volopay’s payment services, which include account issuance, e-money, domestic money transfer, and cross-border money transfer, will be regulated under the Payment Services Act. The major payment institution licence is...

Touch ‘n Go eWallet Expands Payment Coverage in Singapore, Now Accepted at NETS Merchants

Touch ‘n Go eWallet users in Malaysia can now enjoy even wider cashless payment options when travelling to Singapore. The popular eWallet has announced that users can now make payments at any merchant displaying NETS QR via NETS payment terminals or SGQR in the republic. This new partnership is made possible thanks to the recently-announced cross-border partnership between DuitNow and NETS. The expansion of the payment coverage...

hoolah Announces Regional Partnership With Strawberrynet

hoolah, Asia’s leading omni-channel Buy Now Pay Later (BNPL) ecosystem announced its regional partnership with Strawberrynet, the world’s leading online discount beauty retailer to allow consumers from Hong Kong, Singapore and Malaysia to split their purchases across three monthly, interest-free repayments. Founded in 1998, Strawberrynet offers skincare, makeup, fragrance, and hair care products from over 800 premium brands....

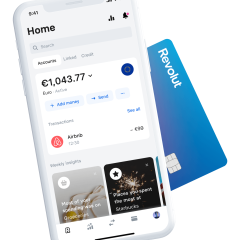

Remittance Firm Revolut Introduces New Review Page with Updated Pricing

Remittance customers can look forward to significant savings if they switch to Revolut from its competitors today. The UK-fintech will be charging a fee for remittances but is keeping its commitment to giving customers some of the most competitive rates in the market. Standard and Premium plan customers will be charged a fee for cross-border transactions. The fee will be 0.3% of the amount transferred, starting at a minimum of S$0.30,...

E-Commerce Aggregator, Una Brands, Raises USD40 Million In Seed Round From Heavy Hitters To Acquire And Scale Brands In APAC

Singapore-based e-commerce startup, Una Brands, today announced that it has raised a USD40 million Seed Round of equity and debt financing, in one of the biggest seed funding rounds seen regionally. Una Brands will use the capital to buy and scale e-commerce brands based in APAC. Kiren Tanna, former CEO of Rocket Internet Asia and Founder of foodpanda and ZEN Rooms, founded Una Brands in 2020. Kiren is backed by four other Co-Founders...