EigenLayer’s $18 Billion Re-Staking Surge Sparks Crypto Market Concerns

EigenLayer has drawn over $18 billion into its re-staking platform, allowing investors to earn multiple yields by staking and re-staking crypto assets. While the potential for higher returns is attractive, analysts warn that the practice could pose significant risks to the crypto market if not managed properly. 31 May 2024 – More than $18 billion worth of cryptocurrency has recently flowed into a new type of platform known as...

MADCash Triumphs with Double Wins at 2024 Money Awareness & Inclusion Awards

MADCash Sdn. Bhd. has won two awards at the 2024 Money Awareness & Inclusion Awards for its impactful work in empowering women entrepreneurs through zero-interest microfunds. The company received accolades for Best For-profit Project for Under-Served Communities and Closing The Gender Gap. 31 May 2024 – MADCash Sdn. Bhd., a rising Malaysian fintech company specializing in zero-interest microfunds for women entrepreneurs, has...

Curlec by Razorpay and TNG Digital Partner to Enhance Financial Inclusion with Recurring Payments in Malaysia

Curlec by Razorpay has partnered with TNG Digital to offer recurring payments through TNG eWallet, enhancing financial accessibility for underserved markets including SMEs and unbanked individuals in Malaysia. This collaboration supports Bank Negara Malaysia’s goal to advance digital financial services and promote a cashless society. 29 May 2024 – Curlec by Razorpay, Malaysia’s foremost FinTech payment gateway,...

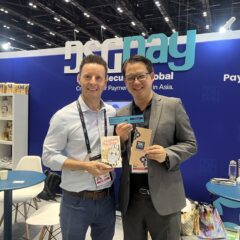

DSGPay Showcases Innovation and Expertise at Money20/20 Asia 2024, Elevating Presence in Bangkok

DSGPay made a significant impact at Money20/20 Asia 2024 in Bangkok, showcasing its cross-border payment solutions and engaging with industry leaders through innovative booth activities and insightful discussions. The company’s successful debut highlights its commitment to driving innovation and expanding its presence in the global fintech landscape. 28 May 2024 – DSGPay, a leading provider of cross-border payment...

Global Forum on Islamic Economics and Finance Inaugurated in Kuala Lumpur to Foster Global Prosperity

The Global Forum on Islamic Economics and Finance convenes in Kuala Lumpur, aiming to leverage Islamic economics and finance to foster shared prosperity and equity. Pioneering initiatives showcased include MLC Impact Projects, Memorandums of Collaboration, and a pilot programme on Greening Halal Businesses, highlighting Malaysia’s commitment to innovative solutions in Islamic finance. 28 May 2024 – The Global Forum on Islamic...

NTT DATA Acquires Majority Stake in GHL Systems to Boost Payment Services in Southeast Asia

NTT DATA has announced the acquisition of a 58.7% stake in GHL Systems Berhad, aiming to strengthen its payment services in the ASEAN region and enhance omni-channel payment solutions in collaboration with iPay88 Malaysia. This strategic move will bolster NTT DATA’s presence and capabilities in the cashless payment ecosystem across Southeast Asia. 27 May 2024 – NTT DATA, a global leader in digital business and IT services,...

AVPN Launches USD 15M AI Opportunity Fund to Empower Asia-Pacific’s Underserved Communities

AVPN, with support from Google.org and ADB, has launched the AI Opportunity Fund: Asia-Pacific, a USD 15-million initiative aimed at equipping underserved communities in Asia with essential AI skills and knowledge to thrive in the evolving work landscape. 27 May 2024 – AVPN, Asia’s largest network of social investors, has announced the launch of the AI Opportunity Fund: Asia-Pacific, backed by Google.org and the Asian...

UnionPay Partners with Leading Merchants to Enable Seamless Online Payments for Global Cardholders

UnionPay has partnered with over 60 major online merchants to enable seamless and secure online payments for UnionPay cards issued outside mainland China, enhancing accessibility for international users through Project Excellence 2024. The initiative aims to support diverse online payment scenarios and improve the global payment experience. 23 May 2024 – UnionPay has recently partnered with over 60 online merchants, including...

Webull Malaysia Launches Cutting-Edge Trading Platform with Zero Commission Trades

Webull Malaysia has launched its advanced global trading platform, offering access to Bursa Securities, Bursa Derivatives, and US-listed stocks and ETFs. The platform aims to democratize investing with advanced tools, educational resources, and zero commission on trades for the first 180 days. 20 May 2024 – Webull Securities (Malaysia) Sdn. Bhd. (“Webull Malaysia”) has announced the launch of its premier global...

Bank Muamalat Partners with Backbase and Mambu for Digital Islamic Banking Transformation

Bank Muamalat Malaysia Berhad has partnered with Backbase and Mambu to transform into a leading digital Islamic bank, focusing on customer-centric digital banking solutions and a modern banking super app. This initiative aims to enhance financial inclusion and operational efficiency through innovative technology and strategic partnerships. 20 May 2024 – In a strategic move to establish itself as a premier next-generation digital...

Moomoo Malaysia Empowers Investors with Fractional Shares Access

Moomoo Malaysia introduces fractional shares for over 500 US stocks and ETFs, aiming to make investment opportunities more accessible to modern Malaysian investors. This initiative facilitates portfolio diversification and informed decision-making through comprehensive resources and investor education. 18 May 2024 – Moomoo Malaysia has announced a significant enhancement to its trading platform, now offering fractional shares of...

Octa Launches STATUS 200 Coding Bootcamp to Empower Underprivileged Students in Kuala Lumpur

Octa is sponsoring the STATUS 200 coding bootcamp at Ideas Academy in Kuala Lumpur, starting June 17, 2024, to provide foundational coding skills to underprivileged youth, supporting Octa’s mission of enhancing financial literacy and educational opportunities in Malaysia. 18 May 2024 – As part of its ongoing commitment to enhancing educational opportunities for diverse social groups, Octa is sponsoring a coding bootcamp...

RAM Ratings and Labuan IBFC Inc. Host Insightful Event on Captive Insurance Solutions

RAM Ratings and Labuan IBFC Inc. hosted an event to explore self-insurance structures, emphasizing the benefits of Labuan captives for risk management, and introduced RAM’s bespoke LECA® service for financial transparency. 17 May 2024 – RAM Rating Services Berhad (RAM Ratings), Malaysia’s premier rating agency, and Labuan IBFC Incorporated Sdn Bhd (Labuan IBFC Inc.), the official marketing agency for Labuan...

Big Tech’s Entry into Finance Spurs Call for New Banking Regulations, Says Basel Committee

Global banking regulators warn that the digitalization of finance and Big Tech’s entry into the banking sector introduce new risks, potentially requiring new regulatory measures to ensure system stability and resilience. 17 May 2024 – Global banking regulators have identified new vulnerabilities and amplified existing risks in the banking system due to the digitalization and entry of Big Tech into finance, according to a...

Eq8 Capital Rebrands and Partners with PhillipCapital to Enhance ETF Access

Eq8 Capital has rebranded and partnered with PhillipCapital to provide greater access to its top-performing EQ8US50 ETF through EPF’s i-Invest portal. This collaboration aims to enhance investment opportunities and expand the ETF market in Malaysia. 15 May 2024 – Eq8 Capital Sdn Bhd (“Eq8”), formerly known as i-VCAP Management Sdn Bhd and Malaysia’s leading equity Exchange Traded Fund (ETF) manager, has...

Labuan IBFC and Qatar Financial Centre Release Joint Publication Promoting Collaboration in Islamic Finance

Labuan IBFC and Qatar Financial Centre (QFC) have jointly launched a publication titled “Mutual Cooperation Towards Global Connectivity”, following an MoU signed last year. The publication highlights potential areas for collaboration in Islamic finance, emphasizing the pivotal roles both jurisdictions play in advancing digitalization and globalization in the industry. 14 May 2024 – Labuan International Business and...

FWD Insurance and BSN Introduce Qaseh Bakti Plus Microinsurance for Underserved Communities in Malaysia

FWD Insurance and BSN have launched Qaseh Bakti Plus, a microinsurance product tailored for underserved communities in Malaysia, offering income replacement in case of hospitalization. This initiative aims to promote financial literacy and inclusion while providing affordable insurance solutions to over three million B40 households. 14 May 2024 – FWD Insurance Berhad (“FWD Insurance”) has collaborated with Bank...

Cuscapi’s MX Global Approved to Trade Worldcoin Token by Securities Commission Malaysia

Cuscapi’s associate MX Global receives approval from Securities Commission Malaysia to trade Worldcoin (WLD) token, which joins the list of permitted digital assets alongside major cryptocurrencies. Worldcoin, an iris biometric cryptocurrency, aims to provide secure online authentication despite facing privacy concerns. 13 May 2024 – Cuscapi Bhd, a digital business solutions provider, has announced that the Securities...

HLIB Introduces Brokerage Fee Waiver on Shopee to Enhance Accessibility to Investments

Hong Leong Investment Bank Bhd (HLIB) has introduced a brokerage fee waiver on Shopee, offering up to RM100 to new customers opening accounts, making it the first bank in Malaysia to do so on the platform. The move is part of HLIB’s commitment to improving accessibility and convenience to investment products, reflecting its efforts to meet customers where they are, particularly in the online space amidst the rise of e-commerce....

Habib Jewels Slapped with RM96,250 Fine for AMLA Violation: BNM’s Crackdown on Financial Crime

Habib Jewels Sdn. Bhd. was fined RM96,250 by BNM for failing to report suspicious transactions as required by AMLA, despite internal red flags. The incident highlights the importance of prompt reporting to mitigate financial crimes and underscores the need for strict compliance within the industry. 10 May 2024 – Bank Negara Malaysia (BNM) has imposed a compound of RM96,250 on Habib Jewels Sdn. Bhd. for its failure to promptly...