Navigating 2024: Key Trends Shaping Business Optimism in Asia Pacific

As businesses in the Asia Pacific region embrace 2024 with optimism, strategic investments in connectivity, technology, and talent become pivotal. Key trends include the strategic evolution of connectivity, the transition of AI from hype to reality, and the imperative to balance sustainability with growth. Eric Wong, Head of Asia Pacific at Expereo, underscores the necessity for businesses to navigate these trends strategically for...

NCS and Microsoft Unveil Pioneering Collaboration for Accelerated AI and Cloud Solutions in Asia Pacific

NCS and Microsoft deepen their collaboration in the Asia Pacific, creating a dedicated growth engine to accelerate the delivery of AI and Cloud solutions. The partnership includes substantial investments in IP creation, Go-to-Market strategies, and the development of capabilities, positioning NCS as a key player in driving innovation and positive impact in the region. 10 January 2024 – Singapore-based NCS has announced an...

YouTrip Elevates User Experience with Increased Wallet Limits and Robust Security Measures, Launches Exciting ‘Trip It to Win It’ Campaign

YouTrip, the favored multi-currency e-wallet in Singapore, unveils elevated wallet limits and advanced security measures, setting a new standard for user convenience and protection during cross-border transactions. 3 January 2024 – YouTrip, the preferred multi-currency e-wallet in Singapore, has unveiled significant improvements to its digital wallet, introducing elevated stock and flow cap limits and reinforcing security...

MAS Implements Temporary Ban on Non-Bank Channels for Singapore-China Remittances Amidst Frozen Account Concerns

Singapore’s MAS issues a 3-month suspension on non-bank channels for remittances to China due to concerns over frozen accounts. The directive aims to protect consumers, prompting remittance companies to exclusively use banks or card networks. MAS advises the public to use alternative channels during the 14-day adjustment period. 20 December 2023 – The Monetary Authority of Singapore (MAS) has issued a notice instructing...

Shopee Expands Influence in Brazil with Strategic Acquisition of Blu’s Local Credit Arm

Shopee, the Singapore-based e-commerce giant, has acquired the local credit arm of Brazilian fintech Blu, marking a strategic move to provide direct credit services in Latin America’s largest economy. The deal, with preliminary approval from Brazil’s antitrust regulator Cade, follows Shopee’s aim to enhance its Brazilian operations and reduce costs, as highlighted in a November legal filing. 19 December 2023 –...

FOMO Pay and Zand Bank Forge Strategic Alliance for Seamless Cross-Border Payments Between Asia and MENA

Singapore’s FOMO Pay and UAE’s Zand Bank have formed a strategic partnership to enable seamless cross-border payments between Asia and the Middle East and North Africa. The collaboration aims to enhance efficiency in B2B transactions, offering businesses streamlined digital payment solutions and banking services for improved connectivity between the two dynamic regions. 14 December 2023 – FOMO Pay, a leading digital...

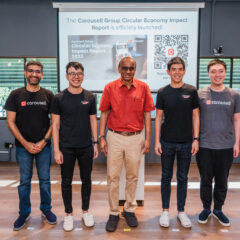

Carousell Group’s Circular Economy Impact Report Reveals Environmental Benefits of Secondhand Shopping in Southeast Asia

Carousell Group’s inaugural Circular Economy Impact Report, released on December 8, 2023, reveals that choosing secondhand items over new ones is a more environmentally conscious choice. The report quantifies Avoided Carbon Emissions, highlighting the platform’s commitment to sustainability and the positive impact of secondhand transactions in reducing carbon footprint. 14 December 2023 – Carousell Group, the premier...

Motorola Chooses VTEX and PayU to Elevate Digital Commerce Experience in India

Motorola India has partnered with VTEX, the global digital commerce platform, to enhance its digital-first strategy and strengthen its direct-to-consumer (D2C) approach. Leveraging VTEX’s responsive platform and a collaboration with PayU, Motorola has implemented affordability schemes and streamlined payment methods, experiencing exceptional growth and doubling its business every month since going live in July 2022. 5 December...

Singapore Aims to Triple AI Experts and Enhance Computing Resources in Ambitious National Strategy

Singapore unveils an ambitious national AI strategy, aiming to triple its pool of AI experts to 15,000, enhance high-performance computing resources through strategic partnerships, and contribute significantly to global tech giant Nvidia’s revenue. The comprehensive plan includes government incentives, local talent development, and a groundbreaking initiative to develop Southeast Asia’s first large language model. 5...

Former CNBC Asia Co-Host Lisa Oake Unveils A Pioneering Hub for Professional Well-Being

Lisa Oake, former co-host of CNBC Asia’s “Squawk Box,” launches ExecutiveCounselling.com, a Singapore-based online counselling platform catering exclusively to executives and professionals. The platform aims to reduce the stigma around seeking mental health support, offering a safe space for high-achieving individuals facing challenges. Sessions are conducted by Singapore-registered therapists with a deep...

GCash Unveils Enhanced International Services and Explores Enterprise Solutions at Singapore Fintech Festival 2023

GCash, the Philippines’ leading finance super app, introduces enhanced international services at the Singapore Fintech Festival 2023. The app now features real-time foreign exchange rates for select countries, reinforcing its position for Filipino travelers and overseas residents. With expanded capabilities and a focus on enterprise services, GCash continues to evolve beyond its core money transfer business. 21 November 2023...

Visa and Tencent Forge Alliance to Transform Cross-Border Remittances for Weixin Users

Visa has partnered with Tencent Financial Technology to facilitate inbound remittances for Weixin users in Mainland China, extending the reach of the Visa Direct network to over one billion users. This collaboration caters to the growing demand for seamless cross-border transactions, leveraging digital wallets and enhancing convenience and security for users and businesses. 17 November 2023 – Visa, a global leader in digital...

Singapore’s MAS Unveils Groundbreaking Initiatives for a Digital Money Future

The Monetary Authority of Singapore (MAS) has introduced three key initiatives, including a digital Singapore dollar blueprint, expanded digital money trials, and the issuance of a “live” CBDC for wholesale settlement, signaling a significant advancement in the country’s digital monetary landscape. These initiatives aim to ensure secure and innovative digital money utilization, encompassing components such as...

Malaysia and Singapore Forge Seamless Cross-Border Payments with DuitNow-PayNow Linkage

Bank Negara Malaysia and the Monetary Authority of Singapore have jointly launched a real-time payment systems linkage between DuitNow and PayNow, enabling instant, secure, and cost-effective cross-border fund transfers. This collaboration, encompassing non-bank financial institutions and aligning with regional initiatives, marks a significant advancement in enhancing the efficiency and accessibility of cross-border payments between...

X-PITCH 2023 Concludes with Million-Dollar Investments and Deeptech Triumphs

The X Games for Startups, X-PITCH 2023, concluded with ten finalists showcasing groundbreaking ideas. Four deeptech startups emerged as winners, securing a total investment of US$1 million. The event featured unconventional semi-finals on Singapore River bumboats, pushing the boundaries of startup competitions. Gratitude is extended to supporting organizations and sponsors, reaffirming X-PITCH’s commitment to fostering...

Qatar and Singapore Join Forces in Historic Innovation Challenge at SWITCH 2023

The Qatar Research, Development, and Innovation Council and Enterprise Singapore have launched the Qatar – Singapore Joint Innovation Challenge (QSJIC) during SWITCH 2023, signifying a historic moment in global innovation collaboration. The initiative calls for innovative solutions in areas like energy, sustainability, and insurtech and aims to foster partnerships between Qatar and Singapore. 2 November 2023 – The Qatar...

Xiaomi’s Visionary Leap: ‘Grow with Xiaomi’ Strategy Unveiled at MIPC Singapore 2024 for Global Internet Services

Xiaomi’s MIPC Singapore 2024 marked a visionary leap, unveiling the ‘Grow with Xiaomi’ strategy to create a global ecosystem for app and game distribution, content delivery, user growth, and monetization services. The conference showcased Xiaomi’s global expansion and innovations in various internet services, highlighting the company’s significant growth potential. 2 November 2023 – The Xiaomi...

AIOX Apex Angel Fund Joins Forces with X-PITCH 2023 to Fuel Deeptech and Web3 Innovation

AIOX Apex Angel Fund has unveiled a new venture fund focused on supporting deeptech and web3 startups. The firm has entered into a strategic partnership with X-PITCH 2023, a global startup competition, to accelerate technology adoption across various industries. 26 October 2023 – AIOX Apex Angel Fund (AIOX) has emerged from the shadows, unveiling an ambitious venture fund geared towards empowering innovators in deeptech and...

OPPO Launches Find N3 and Find N3 Flip: Setting New Standards in Foldable Smartphones

OPPO has released its highly anticipated foldable smartphones, Find N3 and Find N3 Flip, featuring advanced technology, pro-grade cameras, and sleek design, redefining the foldable smartphone category. 19 October 2023 – OPPO, a renowned global smart device brand, has introduced its latest foldable smartphones, the Find N3 and Find N3 Flip, for worldwide availability. These devices represent a significant leap forward in foldable...

NetApp and Equinix Redefine Cloud Management with Hybrid Multicloud Solution

NetApp and Equinix have introduced NetApp Storage on Equinix Metal, an innovative as-a-service solution, designed to deliver a true hybrid cloud experience with cost savings and scalability. This strategic collaboration provides a comprehensive stack of compute, networking, and storage infrastructure, with seamless access to major public clouds, catering to businesses’ evolving needs in a rapidly changing digital landscape. 17...