GHL Enables PayLater by Grab for In-Store Purchases

GHL Systems Berhad (GHL) continues the rollout of PayLater by Grab for its in-store merchants, giving consumers the flexibility of making payment in the following month or in four monthly instalments, with 0% interest. GHL first announced the enablement of PayLater back in 2021 for online merchants. Current GHL merchants include All IT Hypermarket, Afterspring International, Thunder Match Technology, Astro GS Shop and many more....

Revenue Monster Names Kamarul Arifin Mohd Jamil, Former Affin Bank Group CEO, As New Chairman

Revenue Monster Group – a Malaysian financial technology company has appointed former Affin Bank Group CEO, Kamarul Arifin Mohd Jamil, as its new chairman. The appointment marks the Group’s next step in its plans for hypergrowth within the FinTech space. Leveraging Kamarul’s decades of experience in the financial services industry, Revenue Monster Group is poised for an eventful 2023 with a string of high profile partnerships,...

Mastercard Brings More Payment Choices to Consumers in Malaysia with Google Wallet

To meet growing consumer preference for more payment options, Mastercard is bringing contactless payments to consumers in Malaysia, with the launch of Google Wallet in the country today. Mastercard cardholders from CIMB Bank Berhad and Hong Leong Bank Berhad can now save their credit and debit cards within Google Wallet, a digital wallet that enables users to store credit and debit cards, as well as loyalty cards, boarding passes and...

GHL Partners with Alipay+ to Connect Retailers in Malaysia with Mobile-First Asian Travelers

Foreign travelers visiting Malaysia can now pay using their domestic mobile e-wallets at over 40,000 retail outlets powered by GHL Systems Berhad (GHL), which is made possible through a partnership announced today with Alipay+, a global cross-border digital payments and marketing solution. An offering of Ant Group, Alipay+ is designed to enable global businesses, especially small and medium-sized businesses, to accept a wide range of...

Mambu Announces Extended Cloud Approach with Three Leading Cloud Providers

Mambu, the leading SaaS cloud banking platform, has announced general availability across three leading cloud providers Amazon Web Services (AWS), Google Cloud and Microsoft Azure, expanding its global market reach. The fintech’s cloud approach allows complete flexibility for customers to meet ambitious expansion plans seamlessly, giving customers the choice to use the most secure, reliable and high-performance technology stack...

GHL Partners Ablr to Expand Digital Payment Services

As part of its continued efforts in leading the region’s cashless revolution, ASEAN’s payment solutions provider, GHL Systems Berhad (GHL) has joined hands with Buy Now Pay Later (BNPL) player, Ablr, to offer enhanced payment solutions to the growing number of GHL merchants and consumers, providing even greater choice and flexibility when paying for goods and services. By leveraging on Ablr’s white label proprietary platform, GHL will...

Cybersecurity Remains Key To Digital Transformation And Adoption In Malaysia Smes, Says Kaspersky

The Malaysian government introduced Malaysia Digital as the new national strategic initiative to encourage and attract companies, talents, and investments in the country. One of the key focus of Malaysia Digital is digitalising small and medium enterprises (SMEs). Kaspersky’s latest research on digital payments showed that among the countries in Southeast Asia, consumers in Malaysia (72%) strongly favoured the SME’s adoption of...

BNPL Player is Transforming Payments with a Difference

Ablr, a fintech company that provides Buy Now Pay Later (BNPL) service, is now live in Malaysia. Taking on the goal of transforming the payments landscape through BNPL, Ablr provides a unique proposition to the country’s growing BNPL scene by integrating the most flexible plans to date and presenting a different approach by embedding ethical financing through product and services geared towards self and family improvement,...

Mambu Appoints New Suite of Leaders to Support Future Growth

Mambu, the leading SaaS cloud banking platform, has welcomed four new senior hires as it embarks on the next stage of its ambitious growth. The fintech has appointed Werner Knoblich as Chief Revenue Officer (CRO), Fernando Zandona as Chief Technology Officer (CTO), Tripp Faix as Chief Financial Officer (CFO) and Sabrina Dar as Chief of Staff to the CEO. Knoblich and Zandona both join from global hypergrowth, customer-centric...

Bank Islam Introduces FIFA-Themed Credit Card in Malaysia

In partnership with Visa, a global FIFA Partner, Bank Islam Malaysia Berhad (Bank Islam) celebrates the world’s biggest sporting event by offering 10,000 Limited-Edition Visa FIFA-Themed Credit Card-i to new and existing customers. In conjunction with the launch, Bank Islam is organising a special campaign for the Bank Islam Visa FIFA-Themed 2022 Credit Card-i members. Through this campaign, cardmembers stand a chance to win a...

Malaysian Can Pay Taxi Ride in Singapore Using Touch N Go eWallet

One of the largest Singapore taxi operators, ComfortDelGro has announced its collaboration with Alipay+ to cashless transactions among tourists from Malaysia and South Korea while riding the taxi. Under the collaboration, Malaysian can use Touch ‘n Go eWallet to pay the taxi fares without the need to exchange local currency while South Korean can use Kakao Pay to do the same. 12 June 2022 original...

Razer Fintech Enters Indonesia Market through Acquisition of E2Pay

Malaysia’s digital payment company Razer Merchant Services’ parent company Razer Fintech has announced its acquisition of E2Pay, a digital payment facilitator and e-money player in Indonesia to marks its further expansion into Indonesia. Founded in 2012, E2Pay provides a breadth of payment solutions to merchants and financial institutions, including payment gateway, e-money, and remittance services licenses in Indonesia....

Wirex Eases Malaysians to Buy Crypto Using Local Payment Methods

The crypto payments company, Wirex has introduced new payment methods for Indonesian and Malaysian to buy crypto easily on the app using their local banks’ instant bank transfer service. The Wirex Wallet is available globally and was created to make the benefits of DeFi available for everyday users. Considered one of the most accessible wallet products available, it offers an industry-leading user interface and unparalleled...

Bank Negara Malaysia, Banks and Law Enforcement Agencies Work Together to Combat Financial Frauds

Bank Negara Malaysia (BNM) released a statement today that all licensed banks are required to adopt high standards of security, particularly for internet and mobile banking services. This includes routine security reviews and advisories issued by BNM to financial institutions to enhance existing controls and ensure adequate protection against latest threats, while maintaining efficient services for customers. There have been many...

Axaipay Offers SME a Zero Transaction Fee to Accept FPX Transactions

Starting from today, small and medium enterprises (SMEs) in Malaysia can enjoy zero transaction fee for FPX transactions through Axaipay eComPay. Axaipay eComPay is a payment solution powered by Axaipay that facilitate websites and mobile applications to accept multiple payment methods including credit card, debit card, FPX and e-money securely anytime, anywhere. According to the Founder and CEO of Axaipay, Terry Yee, SMEs in the...

Majority of Malaysian Consumers Want Their Bank to Become More Sustainable in The Future

More than three quarters (77%) of Malaysian consumers want their bank or financial institution to become more sustainable in the future, and 65% would consider switching to a bank with a stronger commitment to sustainability, according to a new report from cloud banking platform Mambu. The Is the grass greener on the sustainable side? report surveyed over 6,000 consumers globally, and over 500 from Malaysia, on their attitudes to...

New BNPL Provider Ablr Rolls Out Its Service in Malaysia with Khind

Ablr is now officially available in Malaysia to bring consumers a seamless Buy Now Pay Later (BNPL) solution with payment plans of the greatest flexibility in market to date, enabling Malaysians access to essential purchases that can be paid off over time. Its debut serves to financially assist Malaysians over a wide range of needs, encouraging better monetary management through flexible payments for important purchases. As a fintech...

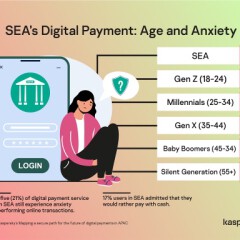

Kaspersky Found One Third of Seniors Gets Anxious When Paying Online

Digital payment has emerged to be the leading choice for many consumers in Southeast Asia (SEA) when it comes to conducting their online financial transactions. A recent Kaspersky research showed that digital considerations about cybersecurity and payments factor heavily into a consumer’s purchasing behavior in the region. Titled “Mapping a secure path for the future of digital payments in APAC”, the study discovered that one in five...

BNM Announces Five Successful Applicants of Digital Bank License

Bank Negara Malaysia (BNM) today announced the five successful applicants for the digital bank licences. The successful applicants are: a consortium of Boost Holdings Sdn. Bhd. and RHB Bank Berhad; a consortium led by GXS Bank Pte. Ltd. and Kuok Brothers Sdn. Bhd; a consortium led by Sea Limited and YTL Digital Capital Sdn Bhd. a consortium of AEON Financial Service Co., Ltd., AEON Credit Service (M) Berhad and MoneyLion Inc.; and a...

MasterCard Introduces New Tool to Improve Online Experience and Prevent Digital Fraud

Mastercard has announced the launch of an enhanced identity solution designed to improve the online shopping experience and tackle digital fraud in a new collaboration with Microsoft Corp. With its enhanced Digital Transaction Insights solution, MasterCard is able to provide financial institutions with the additional intelligence needed to optimize their authorization decisions and approve more genuine transactions. Digital...