Visa Unveils Intelligent Commerce to Power Secure, AI-Driven Shopping and Payments

Visa introduces Visa Intelligent Commerce, a revolutionary platform enabling AI agents to shop and pay on behalf of consumers. The initiative aims to transform the future of commerce, offering a secure and trusted environment for AI-powered transactions. MALAYSIA, 5 MAY 2025 – Visa is pioneering the future of AI-driven commerce with the launch of Visa Intelligent Commerce, a new platform unveiled at the Visa Global Product Drop...

PayNet Launches Malaysia’s First Fintech-Focused Hub to Accelerate Innovation and Global Growth

PayNet has unveiled the PayNet Fintech Hub, Malaysia’s first community and accelerator programme tailored for fintech startups, offering capital access, global mentorship, and sponsored entry into Imperial College London’s accelerator. This initiative aims to position Malaysia as a regional fintech powerhouse by uniting key players and streamlining innovation support. MALAYSIA, 5 MAY 2025 – Payments Network Malaysia Sdn Bhd...

Mastercard and Microsoft Launch Agentic Pay to Power the Future of AI-Driven Commerce

Mastercard has introduced Agentic Pay, a new payments program designed to integrate with generative AI, enabling smarter, more secure transactions across consumer and business use cases. Collaborating with Microsoft and other tech leaders, Mastercard aims to shape the next era of agentic commerce. 30 APRIL 2025 – Mastercard has announced the official launch of its Agentic Payments Program, Mastercard Agent Pay, a transformative...

Curlec by Razorpay Appoints Kevin Lee as Country Head to Drive Next Phase of Growth and Innovation

Curlec by Razorpay has appointed industry veteran Kevin Lee as its new Country Head for Malaysia, aiming to accelerate product innovation, digital payment solutions, and regional expansion. With over 18 years of leadership in fintech, Kevin’s appointment marks a major step in Curlec’s mission to redefine the future of digital payments. MALAYSIA, 28 April 2025 – Curlec by Razorpay, one of Malaysia’s leading payment gateway...

GamBit Group Launches Malaysia’s First Hybrid Asset Trust, Bridging Traditional and Digital Wealth at 50+ Expo 2025

GamBit Group has introduced the Hybrid Asset Trust (H.A.T), Malaysia’s first integrated platform for managing both traditional and digital assets. Launched at the Malaysia 50+ Expo 2025, H.A.T aims to make future-ready estate planning accessible to all Malaysians. MALAYSIA, 28 APRIL 2025 – GamBit Group has officially launched its revolutionary Hybrid Asset Trust (H.A.T) at the Malaysia 50+ Expo 2025, introducing a pioneering...

Asia-Pacific Cross-Border Payments to Soar to US$23.8 Trillion by 2032, Outpacing Global Growth

A new joint report by Money20/20 and FXC Intelligence reveals Asia-Pacific’s cross-border payment volume is set to nearly double by 2032, reaching $23.8 trillion. Fueled by real-time payments, digital wallets, and regional collaboration, the region is becoming a global leader in payment innovation. BANGKOK, 24 APRIL 2025 – Money20/20, the world’s premier fintech event, has unveiled a groundbreaking report in collaboration with...

Asia’s Fintech Future: Regulators Unite at Money20/20 Asia to Drive Regional Cooperation

Money20/20 Asia hosted a high-level closed-door roundtable in Bangkok, uniting regulators from across Asia to chart a path for fintech collaboration, data harmonisation, and consumer protection. The forum emphasized a step-by-step strategy for regional cooperation to unlock the full potential of open finance. THAILAND, 23 APRIL 2025 – A landmark gathering of regulatory leaders from across Asia took place yesterday at Money20/20...

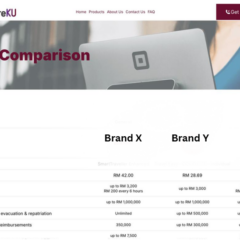

Censof Launches Malaysia’s First Fully Digital Insurance & Takaful Aggregator: insureKU Now Live

Censof Holdings Berhad has officially launched insureKU, Malaysia’s first end-to-end digital insurance and takaful aggregator platform, empowering consumers with a fast, transparent, and simplified way to compare and purchase insurance products. The platform currently offers travel insurance and aims to expand into other categories by year-end. MALAYSIA, 22 APRIL 2025 – Censof Holdings Berhad (“Censof” or “the Group”), a leading...

Google Pay Malaysia Now Integrates ShopeePay and Touch ’n Go eWallet

At the Money 20/20 Asia event in Bangkok, Google announced that ShopeePay and Touch ’n Go eWallet are now supported on Google Pay in Malaysia, offering users enhanced flexibility and payment convenience. THAILAND, 22 APRIL 2025 – In a strategic move to enhance its digital payment ecosystem, Google has officially announced the integration of ShopeePay and Touch ’n Go eWallet with Google Pay in Malaysia. The announcement was made...

CIMB’s InsureXpo 2025 Empowers Singaporeans to Go Beyond Protection and Pursue Financial Prosperity

CIMB’s InsureXpo returned for its second edition on 12 April 2025, drawing record attendance and championing financial literacy through engaging discussions with leading insurers, government agencies, and financial influencers. Themed “From Protection to Prosperity,” the event emphasized insurance as a strategic tool for long-term wealth building and financial resilience. SINGAPORE, 16 APRIL 2025 – InsureXpo by CIMB successfully...

ANNA Money and Shaype Launch Australia’s First AI-Powered Finance Super App for Pty Ltd Businesses

AI-driven fintech ANNA Money partners with Shaype to debut Australia’s first all-in-one financial super app for startups and Pty Ltd companies. The platform streamlines banking, tax, cards, and company formation into a single intelligent solution tailored for SMEs. AUSTRALIA, 16 APRIL 2025 – In a major leap forward for business finance, UK-based fintech ANNA Money has officially entered the Australian market with the launch of...

NTT DATA Payment Services Appoints New CEOs to Accelerate Regional Growth and Digital Commerce Transformation

NTT DATA Payment Services Sdn. Bhd. has appointed Enoch Chhabra and Yuichiro Sato to lead its Payment Services and eCommerce divisions, reinforcing its commitment to regional expansion and digital innovation. MALAYSIA, 15 APRIL 2025 – NTT DATA Payment Services Sdn. Bhd. has announced the strategic appointments of Enoch Chhabra as Chief Executive Officer of Payment Services and e-pay, and Yuichiro Sato as Chief Executive Officer...

Malaysia and Thailand Join Forces to Combat Cybercrime in Financial Sector

Bank Negara Malaysia and the Bank of Thailand have signed a landmark MoU to boost cooperation in cybersecurity and digital fraud prevention. The pact aims to enhance information sharing, capacity building, and joint defences against rising cyber threats in the financial industry. MALAYSIA, 10 APRIL 2025 – The agreement, signed today by BNM Governor Dato’ Seri Abdul Rasheed Ghaffour and BOT Governor H.E. Dr. Sethaput...

Cambodia Joins ASEAN’s Regional Payment Connectivity to Boost Cross-Border Transactions

The National Bank of Cambodia has officially joined ASEAN’s Regional Payment Connectivity (RPC) initiative, becoming the ninth central bank in the region to do so. This move marks a significant step toward seamless cross-border transactions and deeper financial integration in Southeast Asia. MALAYSIA, 9 APRIL 2025 – The National Bank of Cambodia (NBC) has formally joined the Regional Payment Connectivity (RPC) initiative,...

Moomoo Malaysia Wins Big at Malaysia Technology Excellence Awards 2025 for Fintech Innovation

Within just one year of launch, Moomoo Malaysia clinched two top Fintech awards, solidifying its position as a leading digital brokerage by blending AI-powered tools, financial education, and seamless global access for Malaysian investors. MALAYSIA, 4 APRIL 2025 – Moomoo Securities Malaysia Sdn. Bhd. (Moomoo Malaysia) has been honoured with two prestigious accolades — Fintech – Brokerage and Fintech – Financial...

Chubb Unveils Premier Life Science Insurance to Strengthen Risk Protection in APAC

Chubb has launched its Premier Life Science package, a tailored insurance solution designed to address the evolving risks in the life sciences sector. This milestone marks Chubb’s 20-year anniversary in the APAC life sciences market, reinforcing its commitment to supporting innovation in health and science. SINGAPORE, 3 APRIL 2025 – Chubb has announced the launch of its Premier Life Science package, a specialized insurance...

MoneyGram and Mastercard Partner to Revolutionize Cross-Border Payments

MoneyGram and Mastercard have announced a strategic collaboration to enhance digital money transfers globally. Through Mastercard Move, MoneyGram customers can now send and receive funds faster, more securely, and with greater financial accessibility. SINGAPORE, 2 APRIL 2025 – MoneyGram, a leading global financial technology company, has partnered with Mastercard to enhance digital money movement both within the U.S. and across...

Mastercard Unveils Program to Accelerate Virtual Card Adoption and Transform Commercial Payments

Mastercard is introducing a new initiative to accelerate the adoption of Virtual Card Number (VCN) technology, making commercial payments more seamless and consumer-like. The program simplifies integration for banks, platform-partners, and corporate users, reducing onboarding time and improving efficiency in an $80 trillion market. MALAYSIA, 31 MARCH 2025 – Mastercard is revolutionizing commercial payments with a newly launched...

TOP1 Markets Rebrands as TOPONE Markets for Smarter Investing

In February 2025, TOP1 Markets officially rebranded as TOPONE Markets, unveiling a refreshed identity, cutting-edge AI-powered trading tools, and enhanced services designed to empower investors of all levels. SINGAPORE, 12 March 2025 – The transition from TOP1 Markets to TOPONE Markets marks more than just a name change—it signifies a complete transformation in brand philosophy, technology, and user experience. With a refined...

Bizcap Joins AFG Lending Panel to Expand SME Financing Options

Bizcap, a leading provider of fast and flexible business loans, has joined the Australian Finance Group (AFG) lending panel, offering brokers more financing solutions for SMEs. This partnership enhances access to alternative lending, catering to businesses that may not qualify for traditional loans. AUSTRALIA, 26 February 2025 – Bizcap, a prominent provider of rapid and adaptable business loans, has officially joined the...